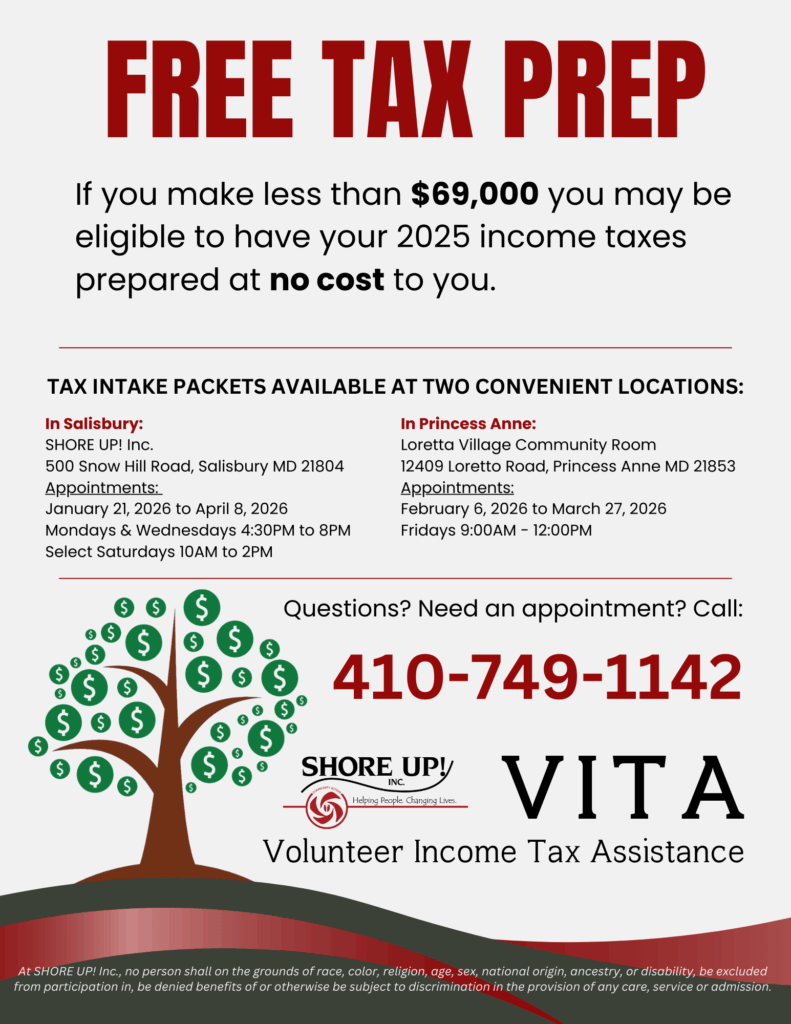

If your household income is $69,000 or less, you may qualify for Free Income Tax Preparation. There are two locations for our Volunteer Income Tax Assistance (VITA) program this year:

LOCATIONS

| Wicomico VITA 500 Snow Hill Road Salisbury MD 21804 |

Somerset VITA 12409 Loretto Road Princess Anne MD 21853 |

Please pick up our Tax Packet at either of our locations. Make certain that you include all required documents. You may either drop off your taxes and documents for preparation or schedule an appointment to meet with a volunteer tax preparer.

Document List:

|

For additional information, contact our Tax Office at eitc@shoreup.org, or call 410-749-1142 x 1903.